Filed by the Registrant | Filed by a Party other than the Registrant | ||||

[ ]

[X]

[ ]

[ ]

[X]

[ ]required

April 28, 2021

hcdi

.Special Meeting.

| Sincerely yours, | |||||

| /s/ Sterling Griffin | |||||

| |||||

NOTICE OF 2021 ANNUAL

JUNE 8, 2021

| To | ||||||||

| ||||||||

| By Order of the Board of Directors | |||||

| January [ ], 2023 | /s/ Sterling Griffin | ||||

| |||||

11505 Burnham Dr.,

Gig Harbor,1200

98402

record, one of which is Cede & Co., a nominee for Depository Trust Company (“DTC”). All of the shares of common stock held by brokerage firms, banks and other financial institutions as nominees for beneficial owners are deposited into participant accounts at DTC, and therefore, are considered to be held of record by Cede & Co. as one stockholder.

There are three proposals

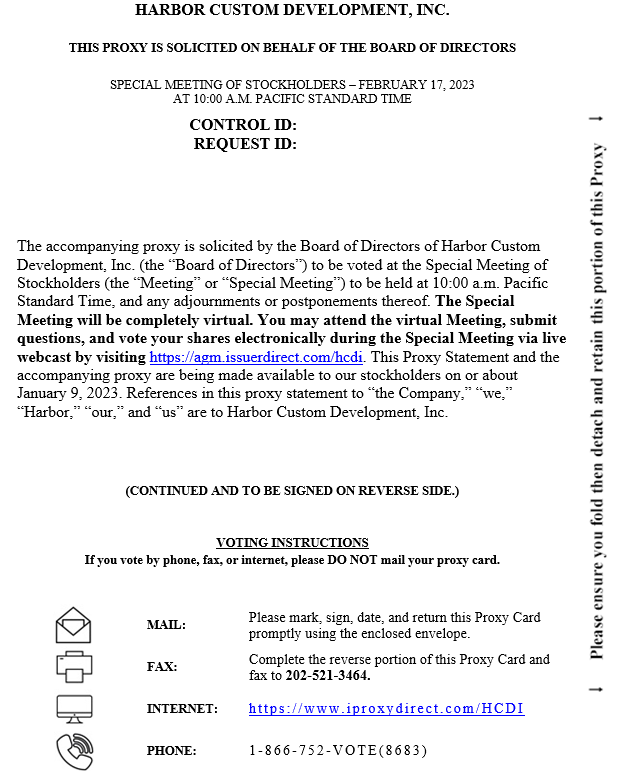

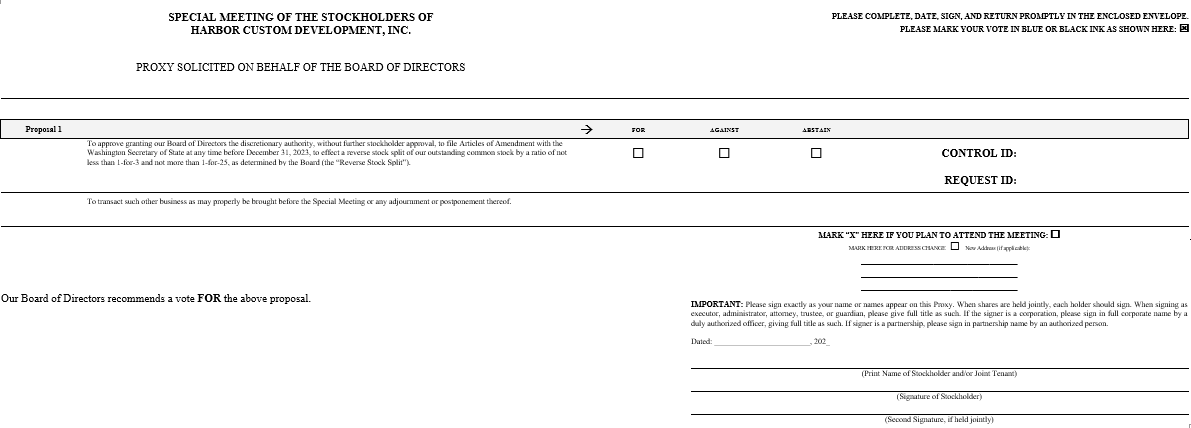

Special Meeting is the approval of a reverse stock split of our issued and outstanding shares of common stock.

| Proposal | Vote Required | Effect of | ||||||

| Approval of Reverse Stock Split with range of 1-for-3 and 1-for-25 | Approval of a | Abstentions and broker non-votes | ||||||

| ● | By Internet: By following the internet voting instructions included in the Notice of Internet Availability of Proxy Materials or by following the instructions on the proxy card at any time up until 11:59 p.m., Eastern | |||||||

| ● | By Telephone: By following the telephone voting instructions included in the Notice of Internet Availability of Proxy Materials or by following the instructions on the proxy card at any time up until 11:59 p.m., Eastern | |||||||

| ● | By Mail: You may vote by mail by marking, dating, and signing your proxy card in accordance with the instructions on it and returning it by mail in the pre-addressed reply envelope provided with the proxy materials. The proxy card must be received prior to the | |||||||

W

e also engaged Morrow Sodali LLC (“Morrow”) to assist with the solicitation of proxies. We have agreed to pay Morrow a fee of approximately $10,000 plus reimbursement of expenses for their services.Overview

We are committed to maintaining high standards of business conduct and corporate governance, which we believe are fundamental to the overall success of our business, serving our stockholders well, and maintaining our integrity in the marketplace. As discussed below, our Board of Directors has established three standing committees to assist it in fulfilling its responsibilities to us and our stockholders: the Audit Committee, the Compensation Committee, and the Nominating and Corporate Governance Committee.

Director Independence

We ceased to be a “controlled company” under the Nasdaq rules on August 28, 2020. We are taking advantage of the phase-in transition periods specified in the Nasdaq rules. Rule 5605 of the Nasdaq Listing Rules requires a majority of a listed company’s board of directors to be comprised of independent directors within one year of listing. In addition, the Nasdaq Listing Rules require that, subject to specified exceptions, each member of a listed company’s audit, compensation, and nominating and corporate governance committees be independent and that audit committee members also satisfy the independence criteria set forth in Rule 10A-3 under the Securities Exchange Act of 1934, as amended (the “Exchange Act”).

We use Nasdaq’s definition of “independence” to make this determination. Nasdaq provides that an “independent director” is a person other than an executive officer or employee of the company or any other individual having a relationship with which, in the opinion of the company’s board of directors, would interfere with the exercise of independent judgment in carrying out the responsibilities of a director. The rules provide that a director cannot be considered independent if:

Under such definitions, our Board has undertaken a review of the independence of each director and will review the independence of any new directors based on information provided by each director concerning their background, employment, and affiliations, in order to make a determination of independence. Our Board has determined that four of our seven nominated directors, Larry Swets, Dennis Wong, Wally Walker, and Karen Bryant are independent.

Meetings of the Board of Directors

During our last fiscal year, our Company was a public company beginning on August 28, 2020, and our Board held three meetings. It is the policy of our Board that all directors should attend the annual meeting of shareholders unless unavoidably prevented from doing so by unforeseen circumstances.

Board Leadership Structure

Sterling Griffin is our Chief Executive Officer, President, and the Chairman of the Board. Our Board believes that it is in our best interest and the best interest of our stockholders for Mr. Griffin to serve in both roles at this time given his knowledge of our business and the industry. We believe our board structure provides appropriate leadership and oversight of our business and facilitates effective functioning of both management and our Board.

Role of our Board of Directors in Risk Oversight

One of the key functions of our Board is informed oversight of our risk management process. We have formed supporting committees, including the Audit Committee, the Compensation Committee, and the Nominating and Corporate Governance Committee, each of which supports the Board by addressing risks specific to its respective areas of oversight. In particular, our Audit Committee has the responsibility to consider and discuss our major financial risk exposures and the steps our management takes to monitor and control these exposures, including guidelines and policies to govern the process by which risk assessment and management is undertaken. The Audit Committee also monitors compliance with legal and regulatory requirements, in addition to oversight of the performance of our internal audit function. Our Compensation Committee assesses and monitors whether any of our compensation policies and programs has the potential to encourage excessive risk-taking. Our Nominating and Corporate Governance Committee provides oversight with respect to corporate governance and ethical conduct and monitors the effectiveness of our corporate governance guidelines, including whether such guidelines are successful in preventing illegal or improper liability-creating conduct.

Committees of our Board of Directors

We are required to have an Audit Committee, Compensation Committee, and Nominating and Corporate Governance Committee. We intend to comply with the requirements of Rule 10A-3 of the Exchange Act and applicable Nasdaq corporate governance rules within the required timeframe.

These rules require that our Audit Committee be composed of at least three members. We are taking advantage of the phase-in allowances, whereby as of the date of our Initial Public Offering, we were required to have at least one independent director on our Audit Committee; 90 days following the Initial Public Offering, a majority of the Audit Committee members must be independent directors; and the Audit Committee is required to be fully comprised of independent directors on the one year anniversary of our Initial Public Offering (August 28, 2021). After the phase-in period, the Audit Committee must be composed exclusively of “independent directors” who are “financially literate” as defined under the Nasdaq listing standards. The Nasdaq listing standards define “financially literate” as being able to read and understand fundamental financial statements, including a company’s balance sheet, income statement and cash flow statement. In addition, we are required to certify to Nasdaq that the committee has, and will continue to have, at least one member who has past employment experience in finance or accounting, requisite professional certification in accounting, or other comparable experience or background that results in the individual’s financial sophistication.

As of the fiscal year ended December 31, 2020, our Audit Committee was composed of Dennis Wong, Wally Walker, and Larry Swets, all of whom were re-appointed to serve on the Audit Committee, subject to and effective upon their elections as directors at this Annual Meeting. Our Board has affirmatively determined that all of the members of the Audit Committee meet the definition of “independent director” for purposes of serving on an Audit Committee under Rule 10A-3 and Nasdaq rules, all of whom qualify as financial experts.

We have established a written charter for our Audit Committee, in which we set forth the duties of the Audit Committee that include, among other matters, oversight responsibilities with respect to the integrity of our financial statements, our compliance with legal and regulatory requirements, the external auditor’s qualifications, independence, and performance, and the performance of our internal audit function as applicable. The Audit Committee’s primary duties and responsibilities are to:

The Audit Committee is also responsible for discussing policies with respect to risk assessment and risk management, including regularly reviewing our cybersecurity and other information technology risks, controls, and procedures and our plans to mitigate cybersecurity risks and respond to data breaches.

Audit committee members must meet the independence requirements of Rule 10A-3 under the Exchange Act, the independence requirements of the Nasdaq listing standards, and all other applicable rules and regulations. The Board of Directors has determined that Dennis Wong, Larry Swets, and Wally Walker are “audit committee financial experts” as that term is defined in SEC regulations. Each member of the Audit Committee is independent and satisfies the applicable requirements for Audit Committee membership under Rule 10A-3 under the Exchange Act and the Nasdaq rules.

A copy of the code of the Audit Committee charter is available on our website at www.harborcustomhomes.com. The inclusion of our website address does not include or incorporate by reference the information on our website into this document.

Nasdaq’s compensation and nominating and committee phase-in requirements as set forth in Listing Rule 5615(c)(3) require that our Compensation Committee and Nominating and Corporate Governance Committee be composed (i) of a majority of independent directors during the phase-in period and (ii) solely of independent directors following the phase-in period. At this time, our Nominating Committee and Compensation Committee is comprised of a majority of independent directors. As of December 31, 2020, the members of each of our Nominating and Corporate Governance Committee and Compensation Committee are Larry Swets, Wally Walker, and Richard Schmidtke, whereby Richard Schmidtke is not an independent director. The Board of Directors has appointed Larry Swets (Chair), Wally Walker, and Richard Schmidtke to serve on the Compensation Committee, subject to and effective upon their election as directors at this Annual Meeting. The Board of Directors has further appointed Wally Walker (chair), Richard Schmidtke, and Karen Bryant to serve on the Nominating Committee, subject to and effective upon their election as directors at this Annual Meeting. After the phase-in provision, the aforementioned committees will be comprised entirely of independent directors. We have also established charters for each of our Nominating Committee and Compensation Committee.

Code of Business Conduct and Ethics

We adopted a written code of business conduct and ethics that applies to our directors, officers, and employees, including our principal executive officer, principal financial officer, principal accounting officer or controller, or persons performing similar functions and agents and representatives, including consultants. A copy of the code of business conduct and ethics is available on our website at www.harborcustomhomes.com. We intend to disclose future amendments to such code, or any waivers of its requirements, applicable to any principal executive officer, principal financial officer, principal accounting officer or controller, or persons performing similar functions or our directors on our website identified above. The inclusion of our website address does not include or incorporate by reference the information on our website into this document.

Communications with the Board of Directors

The Board desires that the views of stockholders be heard by the Board, its Committees or individual directors, as applicable, and that appropriate responses be provided to stockholders on a timely basis. Stockholders wishing to formally communicate with the Board, any Board Committee, the independent directors as a group, or any individual director, may send communications directly to us at Harbor Custom Development, Inc., 11505 Burnham Drive, Suite 301, Gig Harbor, Washington 98332 Attention: Secretary. All clearly marked written communications, other than unsolicited advertising or promotional materials, are logged and copied, and forwarded to the director(s) to whom the communication is addressed. Please note that the foregoing communication procedure does not apply to (i) stockholder proposals pursuant to Exchange Act Rule 14a-8 and communications made in connection with such proposals or (ii) service of process or any other notice in a legal proceeding.

ELECTION OF DIRECTORS

Nominees for Director

Our business is managed under the oversight of our Board of Directors. Our Board accepted the recommendation of the Nominating and Corporate Governance Committee and voted to nominate Sterling Griffin, Richard Schmidtke, Robb Kenyon, Larry Swets, Dennis Wong, Wally Walker, and Karen Bryant for election at the annual meeting for a term of one year to serve until the 2022 annual meeting of shareholders, and until their respective successors have been elected and qualified.

All of the nominees have indicated a willingness to continue serving as directors, and we have no reason to believe that any nominee will be unavailable or unable to serve. If any of them should decline or be unable to act as a director, the proxy holders will vote for the election of any other person or persons the Board may nominate.

Set forth below are the names of the persons nominated for election as directors, their ages, their offices in the Company, if any, their principal occupations or employment for at least the past five years, the length of their tenure as directors, and the names of other public companies in which such persons hold or have held directorships during the past five years. Additionally, information about the specific experience, qualifications, attributes, or skills that led to our Board’s conclusion at the time of filing this proxy statement that each person listed below should serve as a director is set forth below:

| Name | Age | Position with the Company | Date Joined the Board | |||

| Sterling Griffin | 59 | President, Chief Executive Officer, and Chairman | 2018 | |||

| Robb Kenyon | 55 | Director | 2018 | |||

| Richard Schmidtke | 59 | Director | 2020 | |||

| Larry Swets | 46 | Director | 2020 | |||

| Dennis Wong | 52 | Director | 2020 | |||

| Wally Walker | 66 | Director | 2020 | |||

| Karen Bryant | 53 | Director | 2021 |

Sterling Griffin. Our founder, Sterling Griffin, began his career at James S. Griffin Co. in January 1985 as a principal and Vice President of Marketing, where he focused on the syndication of apartment properties, raw land, and retirement home facilities in the Puget Sound region of Washington State. Beginning in June 1989, Mr. Griffin co-founded several businesses over a 12-year period, while actively self-employed as a real estate broker, investor, and developer. In January 2012, he became the Chief Operating Officer for Hudson Homes LLC, a Washington-based residential builder and developer focused on construction of upscale homes in Pierce and Kitsap Counties, where he was responsible for land acquisition, construction, marketing, and sales. In 2014, Mr. Griffin founded our Company. Mr. Griffin is a lifelong Washington resident who graduated from Colorado College with a Bachelor of Arts degree in History in 1984.

Robb Kenyon. Mr. Kenyon served as a Branch Manager and Partner at Seattle Mortgage Company from 1992 through 2004, and then again from 2010 through 2011, where he created, built, and maintained the largest branch in the 60-year history of Seattle Mortgage. He held various managerial positions at Bank of America Home Loans/Countrywide Home Loans from 2004 through 2010. Mr. Kenyon was the California Regional Director of the Home Loan Division of Sterling Savings from March 2011 through March 2012. He was the Director of Regional New Business Development for Cornerstone Home Lending from April 2012 through October 2013. Mr. Kenyon was the Director of Sales – Construction Loans for Builder’s Capital from October 2013 through November 2018. In December 2018, Mr. Kenyon joined as a director of Sound Equity, LLC, a national real estate construction lender. He received his Bachelor of Arts degree in Finance from Seattle University in 1987; graduated from the Aviation Officers Candidate School of the U.S. Navy in 1988; received a Certificate Degree in Construction Management from the University of Washington in 1995; and obtained the Certified New Home Sales Professional Designation from the National Association of Home Builders in 2004; and the Certified Mortgage Bankers Designation from the Mortgage Bankers Association in 2007. Mr. Kenyon is involved in several real estate industry organizations, including the Certified Mortgage Bankers Society, The Seattle Master Builders Association, and The New Home Council.

Richard Schmidtke, C.P.A. Mr. Schmidtke is the founder of Schmidtke & Associates, PLLC, a full-service accounting company he founded in August 2008. Mr. Schmidtke has 30 years of public accounting experience. Mr. Schmidtke has played an essential role in the success of numerous businesses in a wide range of industries including tax planning, real estate, retail, and manufacturing. As a native of Tacoma, Washington, Mr. Schmidtke has established strong relationships in the community. His past and current involvement includes past President and current Trustee and Board Member of Tacoma Goodwill Foundation, Trustee of the Tacoma Art Museum, board member of the Tacoma Community Redevelopment Authority Board, and Tacoma Lawn and Tennis Club. Mr. Schmidtke graduated from the University of Washington with a Bachelor of Arts degree in Economics.

Larry Swets. Mr. Swets founded Itasca Financial LLC, an advisory and investment firm, in 2005 and has served as its managing member since inception. Mr. Swets is also the founder and President of Itasca Golf Managers, Inc., a management services and advisory firm focused on the real estate and hospitality industries. Mr. Swets has served as Chief Executive Officer of GreenFirst Forest Products Inc. (TSXV: GFP) (formerly Itasca Capital Ltd.) since June 2016; as Chief Executive Officer of FG Financial Group, Inc. (Nasdaq: FGF) (formerly 1347 Property Insurance Holdings, Inc.) since November 2020 after having served as Interim CEO from June through November 2020; and as Chief Executive Officer of FG New America Acquisition Corp. (NYSE: FGNA), a special purpose acquisition company, since August 2020. Mr. Swets is a member of the board of directors of FG Financial Group, Inc.; FG New America Acquisition Corp. (NYSE: FGNA); GreenFirst Forest Products Inc.; Limbach Holdings, Inc. (Nasdaq: LMB); Insurance Income Strategies Ltd.; Alexian Brothers Foundation; and Unbounded Media Corporation. Previously, Mr. Swets served as the Chief Executive Officer of Kingsway Financial Services Inc. (NYSE: KFS) from July 2010 through September 2018, including as its President from July 2010 through March 2017.

Prior to founding Itasca Financial LLC, Mr. Swets served as an insurance company executive and advisor, including the role of Director of Investments and Fixed Income Portfolio Manager for Lumbermens Mutual Casualty Company, formerly known as Kemper Insurance. Mr. Swets began his career in insurance as an intern in the Kemper Scholar program in 1994. He previously served as a member of the board of directors of Kingsway Financial Services Inc. from September 2013 through December 2018; Atlas Financial Holdings, Inc. (Nasdaq: AFH) from December 2010 through January 2018; FMG Acquisition Corp. (Nasdaq: FMGQ) from May 2007 through September 2008; United Insurance Holdings Corp. from 2008 through March 2012; and Risk Enterprise Management Ltd. from November 2007 through May 2012. He is a member of the Young Presidents’ Organization. Mr. Swets earned a Master’s degree in Finance from DePaul University in 1999 and a Bachelor’s degree from Valparaiso University in 1997. He also holds the Chartered Financial Analyst (CFA) designation.

Dennis A. Wong. Since 2005, Mr. Wong is the owner of and a consultant with Insurance Resolution Group, a consulting firm focused on providing strategic advisory services to the insurance and financial services sector. From 1997 to 2005, Mr. Wong worked in a variety of corporate roles with Kemper Insurance Companies, a leading national insurance provider, including as Chief Financial Officer of its international operations. From 1991 to 1997, Mr. Wong worked as a public accountant with KPMG LLP, where he specialized in accounting and operational advisory services for the insurance industry. Mr. Wong obtained a Bachelor of Arts degree in Economics with an Accountancy Cognate from the University of Illinois. Mr. Wong is a Certified Public Accountant and has served as an independent member of the board of directors for FG Financial Group, Inc. (Nasdaq: FGF) (formerly 1347 Property Insurance Holdings, Inc.) since August 2015.

Walter “Wally” Walker. In 1987, following a nine-year career as a professional basketball player, Mr. Walker began his financial services career at Goldman Sachs & Co., serving as Vice President of Private Client Services, becoming a Chartered Financial Analyst (CFA) in 1992. In 1994, Mr. Walker returned to professional basketball in the front office to become President of the Seattle SuperSonics of the NBA. Beginning in 2001, he took on the additional role of CEO with the SuperSonics, and served as President and CEO of the Seattle Storm of the WNBA. Upon the sale of the Seattle franchises in 2006, Walker founded Hana Road Capital, LLC, an investment advisory firm in 2007, which he continues to own as well as serving as Chief Investment Officer. Since 2005, Mr. Walker has been a member of the Advisory Council of Stone Arch Capital, a Minneapolis based private equity firm. Mr. Walker also serves on the Board of Trustees of Smead Capital Management, a Seattle based mutual fund. In 2017, Mr. Walker was named an independent director on the board of directors of Atlas Financial Holdings, Inc. Mr. Walker graduated from the University of Virginia in 1976 as an Academic All-American with a Bachelor of Arts degree in psychology. Upon retiring as a player from professional basketball in 1985, he attained a Master of Business Administration degree from Stanford University Graduate School of Business in 1987.

Karen Bryant. For 25 years, Ms. Bryant has run high profile organizations, navigating complex internal and external dynamics while driving business growth and operational excellence. Ms. Bryant was at the helm of women’s professional basketball for 18 years – serving as General Manager of the Seattle Reign and then, ultimately as President & CEO of the Seattle Storm from 2008 through 2014. Under her leadership, the Seattle Storm won two WNBA Championships, set multiple attendance and revenue records, and established itself as one of the WNBA’s premier franchises. In 2014, Ms. Bryant started and led a management consulting firm until one of her clients, Atavus Sports, offered her the role of CEO in 2016. With Atavus, Ms. Bryant led a three-year process of market research, competitive analysis, customer discovery, product development, and sales. In Fall 2019, Atavus was acquired by a private equity firm in a successful exit. After a successful 13-year run as CEO for two organizations, Ms. Bryant returned to her management consulting firm in March 2020. Ms. Bryant also serves as an Executive Coach to business leaders and entrepreneurs and is well-recognized for leading high performing teams. Ms. Bryant’s recognition includes Seattle Sports Commission Executive of the Year, Sports Business Journal Gamechanger, Puget Sound Business Journal Woman of Influence, Greater Seattle Business Association Businessperson of the Year Finalist, and Girl Scouts of Western Washington Woman of Distinction. Ms. Bryant was a scholarship athlete at Seattle University and University of Washington where she graduated in 1991 with a Bachelor of Arts degree in Communication.

Relationships

There are no family relationships between any of our directors or executive officers.

Vote Required and Board Recommendation

If a quorum is present, either in person or by proxy, directors will be elected by a plurality of the votes, which means the seven nominees who receive the greatest number of FOR votes will be elected. If you hold your shares through a broker and you do not instruct the broker on how to vote on this proposal, your broker will not have authority to vote your shares. Abstentions and broker non-votes will each be counted as present for purposes of determining the presence of a quorum, but will not have any effect on the outcome of the proposal.

If any nominee becomes unavailable for any reason (which event is not anticipated) to serve as a director at the time of the Annual Meeting, then the shares represented by such proxy may be voted for such other person as may be determined by the proxy holders, unless a contrary instruction is indicated in the proxy.

Directors are to be elected to hold office until the next annual meeting of stockholders and until their successors are elected and qualified, or their earlier death, resignation, or removal.

THE BOARD OF DIRECTORS RECOMMENDS THAT THE STOCKHOLDERS VOTE FOR THE NOMINEES LISTED ABOVE (ITEM 1 ON THE PROXY CARD).

RATIFICATION OF APPOINTMENT OF ROSENBERG RICH BAKER BERMAN, P.A. AS OURINDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

At the Annual Meeting, our stockholders will be asked to ratify the appointment of Rosenberg Rich Baker Berman, P.A (“RRBB”) as our independent registered public accounting firm for the fiscal year ending December 31, 2021. RRBB has served as our auditor since 2019. Our Audit Committee is responsible for approving the engagement of RRBB as our independent registered public accounting firm for the year ending December 31, 2021. In the event our stockholders fail to ratify the appointment of RRBB, the Audit Committee will reconsider its selection. In addition, even if our stockholders ratify the selection, the Audit Committee in its discretion may direct the appointment of a different independent registered public accounting firm at any time during the year if it believes that a change would be in our best interests and the best interests of our stockholders.

During the two fiscal years ended December 31, 2020 and December 31, 2019, (i) there were no disagreements (as that term is described in Item 304(a)(1)(iv) of Regulation S-K) between us and RRBB on any matters of accounting principles or practices, financial statement disclosures, auditing scope or procedures, or any other matter which, if not resolved to the satisfaction of RRBB, would have caused RRBB to make reference to the subject matter of the disagreements in connection with the issuance of RRBB reports on the financial statements of such periods, and (ii) there were no “reportable events” (as that term is described in Item 304(a)(1)(v) of Regulation S-K) other than as described above.

The Audit Committee meets with RRBB on a minimum of a quarterly basis throughout the year but often on a more frequent basis. At such times, the Audit Committee reviews the services performed by RRBB, as well as the fees charged for such services.

Fees Billed to the Company by its independent auditors during Fiscal Years 2020 and 2019.

The aggregate fees billed for each of the last two fiscal years for professional services rendered by the principal accountant for the annual audit of our financial statements and review of financial statements included in our quarterly reports and services that are normally provided by the accountant in connection with statutory and regulatory filings or engagements for these fiscal periods were as follows:

| For the years ended December 31, | ||||||||

| 2020 | 2019 | |||||||

| Audit Fees | $ | 140,688 | $ | 139,581 | ||||

| Tax Fees | $ | 11,000 | $ | 10,750 | ||||

| Other | $ | 40,000 | $ | 33,778 | ||||

| Total Fees | $ | 191,688 | $ | 184,109 | ||||

Pre-Approval Policies and Procedures

Our Audit Committee pre-approves all audit and permissible non-audit services. These services may include audit services, audit-related services, tax services, and other services. Our Audit Committee approves these services on a case-by-case basis.

Interest of Certain Persons in Matters to be Acted Upon

There are no persons who have a direct or indirect substantial interest in the matter described under Proposal 2 above.

Vote Required and Board Recommendation

The ratification of the appointment of RRBB as our independent registered public accounting firm for the fiscal year ending December 31, 2021 requires a majority of the votes cast, whether in person or represented by proxy, to vote FOR this proposal. Abstentions will be counted as present for purposes of determining the presence of a quorum, but will have no effect on the outcome of the vote.

Submission of the appointment to stockholder approval is not required. However, if our stockholders fail to ratify the appointment, the Audit Committee will reconsider whether to retain RRBB as our independent auditor or whether to consider the selection of a different firm. Even if the appointment is ratified, the Audit Committee in its discretion may direct the appointment of a different independent auditor at any time during the fiscal year ending December 31, 2021.

THE BOARD OF DIRECTORS RECOMMENDS THAT THE STOCKHOLDERS VOTE FOR THE RATIFICATION OF ROSENBERG RICH BAKER BERMAN, P.A. AS INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM FOR THE COMPANY FOR THE FISCAL YEAR ENDING DECEMBER 31, 2021 (ITEM 2 ON THE PROXY CARD).

REPORT OF THE AUDIT COMMITTEE OF THE BOARD OF DIRECTORS

The following is the report of the Audit Committee of the Board of Directors of Harbor Custom Development, Inc.. with respect to Harbor Custom Development, Inc.’s audited financial statements for the fiscal year ended December 31, 2020, included in the Company’s Annual Report on Form 10-K, filed with the SEC on March 31, 2021. The information contained in this report shall not be deemed to be “soliciting material” or to be “filed” with the SEC, nor shall such information be incorporated by reference into any future filing under the Securities Act of 1933, as amended, or the Securities Exchange Act of 1934, as amended, except to the extent that the Company specifically incorporates it by reference in such filing.

The Audit Committee of the Board of Directors currently consists of three non-employee directors, including Messrs. Wong (Chair), Swets, and Walker. The Board has determined that each of Messrs. Wong, Swets, and Walker are “independent directors” under the listing standards of Nasdaq.

The primary purpose of the Audit Committee is to assist the Board of Directors in fulfilling its general oversight of the Company’s financial reporting process. The Audit Committee conducted its oversight activities for the Company in accordance with the duties and responsibilities outlined in the Audit Committee charter. The Audit Committee has the authority to obtain advice and assistance from outside legal, accounting or other advisers as the Audit Committee deems necessary to carry out its duties and to receive appropriate funding, as determined by the Audit Committee, from the Company for such advice and assistance.

The Company’s management is responsible for the preparation, consistency, integrity, and fair presentation of the financial statements, accounting, and financial reporting principles, systems of internal control and procedures designed to ensure compliance with accounting standards, applicable laws and regulations. The Company’s independent registered public accounting firm, RRBB, is responsible for performing an independent audit of the Company’s financial statements.

The Audit Committee hereby reports as follows:

The Audit Committee of the Board of Directors:

/s/ Dennis Wong

Dennis Wong, Chair

PROPOSAL THREEADVISORY VOTE ON EXECUTIVE COMPENSATION

Background

Our Board of Directors and Compensation Committee are providing stockholders with the opportunity to cast an advisory vote on the compensation of our named executive officers. This proposal, commonly known as a “Say on Pay” proposal, gives you, as a stockholder, the opportunity to endorse or not endorse our executive compensation program and the compensation paid to our named executive officers as reported in this Proxy Statement.

The Say on Pay vote is advisory, and therefore not binding on the Compensation Committee or the Board. Although the vote is non-binding, the Compensation Committee and the Board will review the voting results, seek to determine the cause or causes of any significant negative voting, and take the voting results into consideration when making future decisions regarding executive compensation.

The Compensation Committee of the Board of Directors, which is comprised of a majority of independent directors, has the responsibility for evaluating and authorizing the compensation payable to our executive officers. The goal of our executive compensation program is to is to align the interests of our executive officers with those of our shareholders in a way that allows us to attract and retain the best executive talent. To achieve this goal, we have adopted compensation policies with respect to, among other things, setting base salaries, awarding bonuses, and making future grants of equity awards to our executive officers. Our Compensation Committee has designed a compensation program that rewards, among other things, favorable stockholder returns, stock appreciation, our competitive position within the homebuilding industry, and each executive officer’s long-term career contributions to us.

Fiscal Year 2020

During the fiscal year ended December 31, 2020, our “named executive officers” were (i) Sterling Griffin, who serves as our Chief Executive Officer and President, (ii) Anita Fritz, who served as our Vice President; (iii) Lynda Meadows, who serves as our Chief Financial Officer; and (iv) Jeff Habersetzer, who serves as our Secretary.

Elements of Compensation

The compensation incentives designed to further the goals described in Background above take the form of annual cash compensation and equity awards, as well as long-term cash and/or equity incentives measured by company and/or individual performance targets to be established by our Compensation Committee. In addition, our Compensation Committee may decide to make equity-based awards to new executive officers in order to attract talented professionals to serve us.

Annual Base Salary. Base salary is designed to compensate our named executive officers at a fixed level of compensation that serves as a retention tool throughout the executive’s career. In determining base salaries, our Compensation Committee considers each executive’s role and responsibility, unique skills, future potential with us, salary levels for similar positions in our market and internal pay equity. The annual base salaries of our named executive officers are reflected in the Summary Compensation Table included in this Proxy Statement.

Option Plan. Certain executives were issued options pursuant to the 2018 Equity Incentive Plan. We plan to continue to offer option awards to executives, in the discretion of the Board of Directors, considering the executive’s role and other compensation.

401(k) Plan. We offer all of our employees, including executives, a 401k safe harbor match, where 100% of contributions are matched on the first 3% of monies contributed on a pre-tax basis from payroll; and a 50% match on the next 2% that is contributed on a pre-tax basis from payroll.

Health/Welfare Plans. We have a health care and vision plan available to all employees, including our executives, who become eligible after 60 days of employment.

PTO Plan. Executives may take PTO at any time, at their own reasonable discretion.

Stockholders are encouraged to read the Executive Compensation section of this Proxy Statement for a more detailed discussion of our compensation program.

Vote Required

The Board and Compensation Committee believe that out executive compensation program uses appropriate structures and sound pay practices that are effective in achieving our core compensation objectives. Accordingly, the Board recommends that you vote in favor of the following resolution:

“RESOLVED, that the stockholders of Harbor Custom Development, Inc. hereby approve, on an advisory basis, the compensation of the Company’s named executive officers, as disclosed in this proxy statement, under the section entitled “Executive Compensation.”

If a quorum is present, the approval, on a non-binding advisory basis, of the compensation of our named executive officers requires that a majority of the votes cast, whether in person or represented by proxy, are voted FOR this proposal. Abstentions and “broker non-votes” will each be counted as present for purposes of determining the presence of a quorum, but will have no effect on the outcome of the vote.

The approval of this proposal is not a condition to the approval of any other proposals submitted to the stockholders.

THE BOARD OF DIRECTORS RECOMMENDS THAT THE STOCKHOLDERS VOTE FOR THE APPROVAL, ON AN ADVISORY BASIS, OF THE COMPENSATION OF OUR NAMED EXECUTIVE OFFICERS (ITEM 3 ON THE PROXY CARD).

Executive Compensation

Summary Compensation Table

The following is a summary of the elements of our compensation arrangements paid to our executive officers for fiscal years 2020 and 2019.

| Name and Principal Position | Year | Salary ($) | Stock Awards ($) | Option Awards ($) | All Other Compensation ($) | Total ($) | ||||||||||||||||||

| Sterling Griffin, | 2020 | 420,000 | 22,650 | (1) | 35,154 | (2) | 60,539 | (3) | 538,343 | |||||||||||||||

| Chief Executive Officer and President | 2019 | 244,500 | (4) | – | – | 184,341 | (5) | 428,841 | ||||||||||||||||

| Lynda Meadows, Chief Financial Officer | 2020 | 56,167 | (6) | 81,044 | (7) | - | 137,211 | |||||||||||||||||

| Anita Fritz, | 2020 | 100,000 | – | – | 6,475 | (8) | 106,475 | |||||||||||||||||

| (former) Vice President | 2019 | 76,307 | (9) | – | 6,480 | (10) | 4,228 | 87,015 | ||||||||||||||||

| Jeffrey Habersetzer, | 2020 | 123,854 | – | 51,644 | (11) | 3,209 | (8) | 178,707 | ||||||||||||||||

| General Counsel and Secretary | 2019 | 757 | (12) | 757 | ||||||||||||||||||||

We believe that the primary goal of executive compensation is to align the interests of our executive officers with those of our shareholders in a way that allows us to attract and retain the best executive talent. We have adopted compensation policies with respect to, among other things, setting base salaries, awarding bonuses, and making future grants of equity awards to our executive officers. Our Compensation Committee has designed a compensation program that rewards, among other things, favorable stockholder returns, stock appreciation, our competitive position within the homebuilding industry and each executive officer’s long-term career contributions to us.

The compensation incentives designed to further these goals take the form of annual cash compensation and equity awards, as well as long-term cash and/or equity incentives measured by company and/or individual performance targets to be established by our Compensation Committee. In addition, our Compensation Committee may determine to make equity-based awards to new executive officers in order to attract talented professionals to serve us.

Annual Base Salary. Base salary is designed to compensate our named executive officers at a fixed level of compensation that serves as a retention tool throughout the executive’s career. In determining base salaries, our Compensation Committee considers each executive’s role and responsibility, unique skills, future potential with us, salary levels for similar positions in our market, and internal pay equity.

Option Plan. Certain executives were issued options pursuant to the 2018 Equity Incentive Plan. We plan to continue to offer option awards to executives, in the discretion of the Board of Directors, considering the executive’s role and other compensation.

Outstanding Equity Awards at Year End

The following table sets forth information regarding outstanding stock options held by our executive officers in 2020 and 2019:

| Name | Grant Date | Number of Securities Underlying Options | Vesting Commencement Date | Exercise Price per share | Expiration Date | ||||||||||

| Sterling Griffin, | 12/31/2018 | 67,568 | 01/01/2019 | (1) | $ | 0.44 | 12/31/2023 | ||||||||

| Chief Executive Officer and President | 10/13/2020 | 20,000 | 12/31/2020 | (2) | $ | 5.15 | 10/13/2030 | ||||||||

| Lynda Meadows, Chief Financial Officer | 09/21/2020 | 40,000 | 09/21/2020 | (3) | $ | 5.00 | 09/21/2030 | ||||||||

| Anita Fritz, Vice President | 02/01/2019 | 16,217 | 09/01/2019 | (4) | $ | 0.40 | 05/04/2021 | ||||||||

| Jeffrey Habersetzer, | 12/19/2019 | 9,010 | 12/19/2019 | (5) | $ | 0.40 | 12/19/2029 | ||||||||

| General Counsel and Secretary | 09/01/2020 | 20,000 | 09/01/2020 | (6) | $ | 6.50 | 09/01/2030 | ||||||||

The following table sets forth information regarding restricted stock units (“RSUs”) held by our executive officers in 2020 and 2019:

| Name | Grant Date | Number of RSUs Granted | Vesting Commencement Date | Market Value of Stock Award (2) | ||||||||||

| Sterling Griffin, | 12/03/2020 | 5,000 | 12/31/2020 | (1) | $ | 22,650 | ||||||||

Other Elements of Compensation

401(k) Plan. We offer all of our employees, including executives, a 401k safe harbor match, where 100% of contributions are matched on the first 3% of monies contributed on a pre-tax basis from payroll; and a 50% match on the next 2% that is contributed on a pre-tax basis from payroll.

Health/Welfare Plans. We have a health care and vision plan available to all employees, including our executives, who become eligible after 60 days of employment.

PTO Plan. Executives may take PTO at any time, at their own reasonable discretion.

Employment Agreements with our Named Executive Officers

Employment Agreement with Sterling Griffin

We have an employment agreement with Sterling Griffin as our Chief Executive Officer and President, effective January 1, 2019. This employment agreement is for a term of ten years with automatic one-year renewals unless either party gives notice of termination at least 30 days prior to the expiration of its initial term or any renewal term. Mr. Griffin is entitled to an annual salary of $420,000, discretionary bonuses in the discretion of the board of directors, 67,568 options pursuant to the 2018 Equity Incentive Plan, an automobile allowance in the discretion of the Board, and participation in all benefit plans, such as paid vacation and health insurance. In the event of our termination of Mr. Griffin without cause, Mr. Griffin is entitled to 26 weeks of his then salary as severance.

Offer Letter to Lynda Meadows

Ms. Meadows entered into an employment offer letter with us that provides for Ms. Meadows’ employment as Chief Financial Officer, reporting to our Chief Executive Officer. In accordance with the terms of the offer letter, Ms. Meadows is paid an annual salary of $200,000, and her annual target bonus is 60% of her annual base salary, based on objectives to be determined by the parties. In addition, Ms. Meadows was granted options to purchase 40,000 shares of our common stock pursuant to our 2018 Equity Incentive Plan. Her offer letter further provides that medical benefits are available for enrolment after 60 calendar days of employment and participation in our 401K Retirement Plan is available for enrolment at the initial quarter following 90 days of employment.

Agreement with Anita Fritz

On August 16, 2018, we sent an offer of employment to Anita Fritz for the full-time position of Vice President with a salary of $85,000. On February 1, 2019, Ms. Fritz was issued 16,217 options pursuant to the 2018 Equity Incentive Plan. As of January 1, 2020, Ms. Fritz was entitled to a salary of $100,000, and participation in all benefit plans, such as paid vacation and health insurance. Ms. Fritz retired on February 4, 2021.

Offer Letter to Jeff Habersetzer

On December 18, 2019, Mr. Habersetzer was offered employment with a starting salary of $112,500, with a bonus retention of $12,500 following a successful one-year performance review. Mr. Habersetzer was issued 20,000 options pursuant to the 2018 Equity Incentive Plan, as well as participation in all benefit plans including health insurance. Mr. Habersetzer’s salary was increased to $140,000 on June 15, 2020. On March 22, 2021 Mr. Habersetzer’s salary was increased to $160,000.

2018 Equity Incentive Plan

On November 12, 2018, we adopted the 2018 Equity Incentive Plan which provides for the grant of incentive stock options within the meaning of Section 422 of the Internal Revenue Code of 1986, as amended (the “Code”), to our employees and the employees of any subsidiary corporation, and for the grant of non-statutory stock options to non-employees, including directors and other service providers.

Authorized shares. A total of 675,676 shares of our common stock have been reserved for issuance pursuant to the exercise of options issued from the 2018 Equity Incentive Plan.

Plan administration. Our Board of Directors administers our 2018 Equity Incentive Plan.

Stock options. Stock options may be granted under our 2018 Equity Incentive Plan. The exercise price of options granted under our 2018 Equity Incentive Plan must at least be equal to the fair market value of our common stock on the date of grant. The term of an incentive stock option may not exceed ten years, except that with respect to any participant who owns more than 10% of the voting power of all classes of our outstanding stock, the term must not exceed five years and the exercise price must equal at least 110% of the fair market value on the grant date. The administrator will determine the methods of payment of the exercise price of an option, which may include cash, shares, or other property acceptable to the administrator, as well as other types of consideration permitted by applicable law. After the termination of service of an employee, director, or consultant, he or she may exercise his or her option for the period of time stated in his or her option agreement. Generally, if termination is due to death or disability, the option will remain exercisable for 12 months. In all other cases, the option will generally remain exercisable for three months following the termination of service. However, in no event may an option be exercised later than the expiration of its term. Subject to the provisions of our 2018 Equity Incentive Plan, the administrator determines the other terms of options.

Options Granted. As of the date of this Annual Report, pursuant to our 2018 Equity Incentive Plan, we have issued 442,172 options to purchase shares of our common stock to our employees, officers, and directors.

Non-transferability of awards. Unless the administrator provides otherwise, our 2018 Equity Incentive Plan generally does not allow for the transfer of awards and only the recipient of an award may exercise an award during his or her lifetime.

Certain adjustments. In the event of certain changes in our capitalization, to prevent diminution or enlargement of the benefits or potential benefits available under our 2018 Equity Incentive Plan, the administrator will adjust the number and class of shares that may be delivered under our 2018 Equity Incentive Plan and/or the number, class, and price of shares covered by each outstanding award and the numerical share limits set forth in our 2018 Equity Incentive Plan. In the event of our proposed liquidation or dissolution, the administrator will notify participants as soon as practicable and all awards will terminate immediately prior to the consummation of such proposed transaction.

Merger or change in control. Our 2018 Equity Incentive Plan provides that in the event of a merger or change in control, as defined under the 2018 Equity Incentive Plan, each outstanding award will be treated as the administrator determines, except that if a successor corporation or its parent or subsidiary does not assume or substitute an equivalent award for any outstanding award, then such award will fully vest, all restrictions on the shares subject to such award will lapse, all performance goals or other vesting criteria applicable to the shares subject to such award will be deemed achieved at 100% of target levels and all of the shares subject to such award will become fully exercisable, if applicable, for a specified period prior to the transaction. The award will then terminate upon the expiration of the specified period of time.

Amendment, termination. The administrator has the authority to amend, suspend, or terminate the 2018 Equity Incentive Plan provided such action will not impair the existing rights of any participant. Our 2018 Equity Incentive Plan will automatically terminate in 2028, unless we terminate it sooner.

2020 Restricted Stock Plan

Purpose of the 2020 Restricted Stock Plan. The 2020 Restricted Stock Plan is intended to provide incentives which will attract, retain, motivate, and reward officers, directors, and key employees of us or any of our Affiliates (“Participants”), by providing them opportunities to acquire shares of our common stock.

Stock Subject to the Plan. The aggregate number of shares of common stock that may be subject to Awards granted under the 2020 Restricted Stock Plan is 700,000 shares of common stock. If any shares of common stock are forfeited, retained by us as payment of tax withholding obligations with respect to an Award, or surrendered to us to satisfy tax withholding obligations, such shares will be added back to the shares available for Awards. The 2020 Restricted Stock Plan contains certain adjustment provisions relating to stock dividends, stock splits, and the like.

Administration of the 2020 Restricted Stock Plan. The 2020 Restricted Stock Plan is administered by the Compensation Committee (the “Committee”) of the Board of Directors. The Committee has the full power and authority to grant Awards to the persons eligible to receive such Awards and to determine the amount, type, terms, and conditions of each such Award.

Eligibility. Participants consist of such officers, directors, and key employees of us or any of our Affiliates as the Committee, in its sole discretion, determines to be significantly responsible for our success and future growth and profitability and whom the Committee may designate from time to time to receive Awards under the 2020 Restricted Stock Plan.

Types of Awards. Stock Awards and Performance Awards may, as determined by the Committee, in its discretion, constitute Performance-Based Awards.

Stock Awards

The Committee is authorized to grant Stock Awards and will, in its sole discretion, determine the recipients and the number of shares of common stock underlying each Stock Award. Each Stock Award will be subject to such terms and conditions consistent with the 2020 Restricted Stock Plan as determined by the Committee and as set forth in an Award agreement, including, without limitation, restrictions on the sale or other disposition of such shares and our right to reacquire such shares for no consideration upon termination of the Participant’s employment or membership on the Board, as applicable, within specified periods.

Performance Awards

The Committee is authorized to grant Performance Awards and will, in its sole discretion, determine the recipients and the number of shares of common stock that may be subject to each Performance Award. Each Performance Award will be subject to such terms and conditions consistent with the 2020 Restricted Stock Plan as determined by the Committee and as set forth in an Award agreement. The Committee will set performance targets at its discretion which, depending on the extent to which they are met, will determine the number of Performance Awards that will be paid out to the Participants and may attach to such Performance Awards one or more restrictions. Performance targets may be based upon, without limitation, Company-wide, divisional and/or individual performance.

The Committee has the authority to adjust performance targets. The Committee also has the authority to permit a Participant to elect to defer the receipt of any Performance Award, subject to the 2020 Restricted Stock Plan.

Performance-Based Awards

Certain Stock Awards and Performance Awards granted under the 2020 Restricted Stock Plan and the compensation attributable to such Awards are intended to (i) qualify as Performance-Based Awards or (ii) be otherwise exempt from the deduction limitation imposed by Section 162(m) of the Code. The Committee determines whether Stock Awards and Performance Awards granted under the 2020 Restricted Stock Plan qualify as Performance-Based Awards. The Committee will establish in writing the performance goals, the vesting period, the performance targets, and any other terms and conditions of the Award in its sole discretion.

Vesting. Awards granted to Participants under the 2020 Restricted Stock Plan may be subject to a graded vesting schedule with a minimum vesting period of two years, unless otherwise determined by the Committee.

If we have a Change in Control, all unvested Awards granted under the 2020 Restricted Stock Plan will become fully vested immediately upon the occurrence of the Change in Control and such vested Awards will be paid out or settled, as applicable, within 60 days upon the occurrence of the Change in Control, subject to requirements of applicable laws and regulations.

Subject to the discretion of the Committee, if a Participant’s employment or membership on the Board is terminated due to death or Disability, then all unvested and/or unearned Awards will be forfeited as of such date.

Section 409A of the Code

Awards under the 2020 Restricted Stock Plan are intended either to be exempt from the rules of Section 409A of the Code or to satisfy those rules and shall be construed accordingly. However, we will not be liable to any Participant or other holder of an Award with respect to any Award-related adverse tax consequences arising under Section 409A or other provision of the Code.

Transferability. Each Award granted under the 2020 Restricted Stock Plan will not be transferable otherwise than by a will or the laws of decent and distribution or as otherwise decided by the Committee.

Fair Market Value. For purposes of the 2020 Restricted Stock Plan, “Fair Market Value” means, as of any given date, the closing price of a share of common stock on Nasdaq or such other public trading market on which shares of common stock are listed or quoted on that date.

Withholding. All payments or distributions of Awards made pursuant to the 2020 Restricted Stock Plan will be net of any amounts required to be withheld pursuant to applicable federal, state, and local tax withholding requirements.

Amendments. Our Board or the Committee may amend the 2020 Restricted Stock Plan from time to time or suspend or terminate it at any time. However, no amendment will be made, without approval of our shareholders to (i) increase the total number of shares which may be issued under the 2020 Restricted Stock Plan; (ii) modify the requirements as to eligibility for Awards under the 2020 Restricted Stock Plan; or (iii) otherwise materially amend the 2020 Restricted Stock Plan as provided in Nasdaq rules.

Term of the 2020 Restricted Stock Plan. The 2020 Restricted Stock Plan will terminate on the seventh anniversary of its Effective Date.

Current Issuance. As of the date of this Annual Report, there were 34,000 Awards issued under the 2020 Restricted Stock Plan.

Our directors play a critical role in guiding our strategic direction and overseeing the management of our Company. Ongoing developments in corporate governance and financial reporting have resulted in an increased demand for such highly qualified and productive public company directors. The many responsibilities and risks and the substantial time commitment of being a director of a public company require that we provide adequate incentives for our directors’ continued performance by paying compensation commensurate with our directors’ workload.

Our director compensation is overseen by the Compensation Committee, which makes recommendations to our Board of Directors on the appropriate structure for our non-employee director compensation program and the appropriate amount of compensation to offer to our non-employee directors. Our Board of Directors is responsible for final approval of our non-employee director compensation program and the compensation paid to our non-employee directors.

Director Compensation

The following table sets forth information regarding the compensation earned for service on our board of directors in 2020. We reimburse all directors for their reasonable out of pocket expenses incurred in connection with the performance of their duties as directors, including without limitation, travel expenses in connection with their attendance in-person at board and committee meetings.

| Director Name | Cash | Restricted Stock Awards(2) | Option Awards(3) | Total | ||||||||||||

| Sterling Griffin(1) | $ | 22,650 | 35,154 | $ | 57,804 | |||||||||||

| Richard Schmidtke(1) | $ | 22,650 | 35,154 | $ | 57,804 | |||||||||||

| Robb Kenyon(1) | $ | 22,650 | 35,154 | $ | 57,804 | |||||||||||

| Larry Swets(1) | $ | 22,650 | 35,200 | (4) | $ | 57,850 | ||||||||||

| Dennis Wong | $ | 25,000 | $ | 40,770 | (5) | 35,154 | $ | 100,924 | ||||||||

| Wally Walker(1) | $ | 22,650 | 35,154 | $ | 57,804 | |||||||||||

We anticipate issuing stock options under our 2018 Equity Incentive Plan and Restricted Stock under our 2020 Restricted Stock Plan to current and new directors in the future to compensate them for their service.

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

our directors and executive officers as a group; and

| Amount and Nature of Beneficial Ownership | ||||||||

| Name and Address of Beneficial Owner (10) | Number of Shares of Common Stock | Percentage of Class | ||||||

| Directors and Named Executive Officers: | ||||||||

| Sterling Griffin, Chief Executive Officer, President, Director | 2,747,457 | (1) | 18.4 | % | ||||

| Lynda Meadows, Chief Financial Officer | 6,666 | (2) | * | |||||

| Jeff Habersetzer, Secretary and General Counsel | 12,649 | (3) | * | |||||

| Robb Kenyon, Director | 46,284 | (4) | * | |||||

| Richard Schmidtke, Director | 136,374 | (5) | * | |||||

| Larry Swets, Director | 97,450 | (6) | * | |||||

| Dennis Wong, Director | 22,833 | (7) | * | |||||

| Wally Walker, Director | 29,600 | (8) | * | |||||

| All directors and executive officers as a group (eight persons) | 3,099,313 | 20.6 | % | |||||

| 5% or Greater Stockholder | ||||||||

| Laurence O. Elvins(9) | 535,765 | 3.6 | % | |||||

| Amount and Nature of Beneficial Ownership | ||||||||||||||||||||||||||

| Name and Address of Beneficial Owner(8) | Number of Shares of Common Stock | Percentage of Class | ||||||||||||||||||||||||

| Directors and Named Executive Officers: | ||||||||||||||||||||||||||

| Sterling Griffin, Chief Executive Officer, President, Director | 2,789,796 | (1) | 19.4 | % | ||||||||||||||||||||||

| Jeff Habersetzer, Chief Operating Officer | 131,466 | (2) | * | |||||||||||||||||||||||

| Lance Brown, Chief Financial Officer | 57,067 | (3) | * | |||||||||||||||||||||||

| Richard Schmidtke, Director | 170,874 | (4) | 1.2 | % | ||||||||||||||||||||||

| Larry Swets, Director | 120,450 | (5) | * | |||||||||||||||||||||||

| Dennis Wong, Director | 56,833 | (6) | * | |||||||||||||||||||||||

| Wally Walker, Director | 109,000 | (7) | * | |||||||||||||||||||||||

| Karen Bryant, Director | 10,000 | * | ||||||||||||||||||||||||

| Chris Corr, Director | 19,960 | * | ||||||||||||||||||||||||

| All directors and executive officers as a group (nine persons) | 3,465,446 | 23.6 | %(9) | |||||||||||||||||||||||

(1) Includes options to purchase 87,568 shares | ||

DELINQUENT SECTION 16(a) REPORTS

Section 16(a) of the Exchange Act requires that our officers, directors, and persons who own more than 10%common stock.

| Name and Affiliation | No. of Late Reports | No. of Transactions Not Filed on a Timely Basis | Known Failures to File | |||

| Sterling Griffin, Chief Executive Officer, President, Chairman, and Director | 1 | 2 | None | |||

| Lynda Meadows, Chief Financial Officer | 1 | 1 | None | |||

| Anita Fritz, Vice President | 0 | 0 | None | |||

| Jeffrey B. Habersetzer, Secretary | 1 | 2 | None | |||

| Robb Kenyon, Director | 1 | 3 | None | |||

| Larry Swets, Director | 2 | 3 | None | |||

| Wally Walker, Director | 1 | 3 | None | |||

| Dennis Wong, Director | 1 | 3 | None | |||

| Richard Schmidtke, Director | 1 | 2 | None |

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS

Certain Relationships and Related Transactions, and Director Independence

Notes Payable

We entered into construction loans with Sound Equity, LLC of which a director and minority shareholder is a partner. These loans were originated between April 2019 and October 2020; all of the loans have a one-year maturity with interest rates ranging between 7.99% and 12.00%. For the years ended December 31, 2020, and 2019, we incurred loan origination fees of $418,300 and $771,700, respectively. These fees are recorded as debt discount and amortized over the life of the loan. The amortization is capitalized to real estate. As of December 31, 2020, and 2019, there were $202,500 and $402,300 of remaining debt discounts, respectively. We incurred prepaid interest of $726,500 and $705,700, respectively. This interest is recorded as debt prepaid interest and amortized over the life of the loan. The interest is capitalized to real estate. As of December 31, 2020 and 2019, there were $466,600 and $451,500 of remaining prepaid interest reserves, respectively. As of December 31, 2020 and 2019, the outstanding loan balances were $6,438,100, and $14,935,000, respectively. As of March 31, 2021, the balance of remaining debt discount was $816,300 and the balance of these loans was $7,166,400.

We entered into a construction loan with Curb Funding, LLC of which a director and minority shareholder is 100% owner. The loan originated August 13, 2020. The loan has a one-year maturity with an interest rate of 12%. For the years ended December 31, 2020 and 2019, we incurred loan fees of $3,500 and $0, respectively. These fees are recorded as debt discount and amortized over the life of the loan. The amortization is capitalized to real estate. As of December 31, 2020 and 2019, there were $1,100 and $0 of remaining debt discounts, respectively. As of December 31, 2020 and 2019, the outstanding loan balances were $51,800, and $0, respectively. We incurred interest expense of $3,000 and $0 for the years ended December 31, 2020 and 2019, respectively. This loan was paid off on January 13, 2021.

On April 19, 2019, we entered into a construction loan with Olympic Views, LLC of which our Chief Executive Officer and President, owned a 50% interest at that time. The loan amount was $442,000 with an interest rate of 12% and a maturity date of April 19, 2020. The loan was collateralized by a deed of trust on the land. The amounts outstanding were $0 and $442,000 as of December 31, 2020 and 2019, respectively. The interest expense was $17,400 and $37,600 for the years ended December 31, 2020 and 2019 and was capitalized as part of real estate. We entered into an agreement with Olympic Views, LLC to convert this debt and accrued interest of $55,000 to common stock at the initial public offering price of $6.00 in May of 2020. This conversion was done on August 28, 2020 simultaneous with our initial public offering. This transaction resulted in 82,826stock.

Duemaintain our common stock listing on the Nasdaq Capital Market. The ratio for the Reverse Stock Split will be selected at the sole discretion of our Board of Directors at any whole number in the foregoing range (the “Approved Range”), with fractional shares as a result of the Reverse Stock Split to Related Party

We utilize a quarrybe rounded up to process waste materialsthe nearest whole share. A vote “FOR” the Reverse Stock Split will constitute approval of the Reverse Stock Split. If our stockholders approve the Reverse Stock Split, our Board will have the authority, but not the obligation, in its sole discretion and without further action on the part of our stockholders, to select the Reverse Stock Split ratio in the Approved Range and implement the Reverse Stock Split. The Board reserves the right to abandon the Reverse Stock Split at any time prior to implementation if it determines, in its sole discretion, that the Reverse Stock Split is no longer in the best interests of the Company and its stockholders. Except for any changes that may result from the completiontreatment of raw land into sellable/buildable lots. fractional shares as described below, each stockholder will hold the same percentage of common stock outstanding immediately following the Reverse Stock Split as such stockholder held immediately prior to the Reverse Stock Split.

Due to Related Party

Richard Schmidtke, oneclosing bid price of our directors, provided accounting servicescommon stock is at least $1.00 for a minimum of ten consecutive business days, Nasdaq will provide us with written confirmation of compliance. We are

Land Purchase from a Related Party

On September 2, 2020, we purchased 99 unfinished lots for $3,430,000 from Olympic Views, LLC. Sterling Griffin, our Chief Executive Officer and President owned a 50% interest in this LLC at the date of purchase, but currently has nowill not affect any stockholder’s percentage ownership interest in this LLC.

Land Distributionthe Company (subject to the treatment of fractional shares), or any stockholders’ proportionate voting power (subject to the treatment of fractional shares).

| Common Stock and Equivalents Outstanding Prior to Reverse Stock Split | Common Stock and Equivalents Outstanding Assuming Certain Reverse Stock Split Ratios | |||||||||||||||||||

| Shares | Percent of Total Authorized | 1-for-3 | 1-for 12 | 1-for-25 | ||||||||||||||||

| Common Outstanding | 14,376,691 | 28.75% | 4,792,230 | 1,198,058 | 575,068 | |||||||||||||||

| Common Underlying Series A | 21,111,683 | 42.22% | 7,037,228 | 1,759,307 | 844,467 | |||||||||||||||

| Common Underlying HCDIZ Warrants | 66,672 | 0.13% | 22,224 | 5,556 | 2,667 | |||||||||||||||

| Common Underlying HCDIW Warrants | 18,447,564 | 36.90% | 6,149,188 | 1,537,297 | 737,903 | |||||||||||||||

| Common Reserved for 2018 Stock Option Plan | 2,675,676 | 5.35% | 891,892 | 222,973 | 107,027 | |||||||||||||||

| Common Reserved for 2020 Restricted Stock Plan | 2,700,000 | 5.40% | 900,000 | 225,000 | 108,000 | |||||||||||||||

| Total Common Stock and Equivalents | 59,378,286 | 118.76% | 19,792,762 | 4,948,191 | 2,375,131 | |||||||||||||||

| Common Stock Available for Future Issuance | (9,378,286) | 30,207,238 | 45,051,810 | 47,624,869 | ||||||||||||||||

Compensation of Our Current Directors and Executive Officers

For informationdissenters’ or appraisal rights with respect to the compensation offeredReverse Stock Split, and we will not independently provide stockholders with any such rights.

Related Party Transaction Policyconnection with the Reverse Stock Split, and Procedures

no gain or loss will be recognized by stockholders who exchange their shares of pre-split common stock for shares of post-split common stock. The above transactions madepost-split common stock in the hands of a stockholder following the Reverse Stock Split will have an aggregate tax basis equal to the aggregate tax basis of the pre-split common stock held by that stockholder immediately prior to 2019 were entered into by our predecessor, Harbor LLC, and were approved by Sterling Griffin, the Manager and sole Member of Harbor LLC atReverse Stock Split. A stockholder’s holding period for the time. All future related party transactionspost-split common stock will be voted upon by the disinterested Board of Directors. The Audit Committeesame as the holding period for the pre-split common stock.

proposal.

Meeting.

| By Order of the Board of Directors | |||||

| /s/ Sterling Griffin | |||||

Sterling Griffin

Chief Executive Officer | |||||